Clear Seas Research releases report on today's challenges and industry perspective, during COVID-19 crisis (Part Three)

Clear Seas Research (a BNP Media Company) is uniquely positioned to engage with industry professionals in niche market sectors, which are all impacted in different ways by the coronavirus pandemic. The unrivaled industry access available to Clear Seas Research through myCLEARopinionPanel and BNP Media subscriber databases provides extensive reach to business thought leaders, decision makers, decision influencers, skilled trade professionals, and general employees of companies of all sizes.

Our research expertise and audience access enables us to collect, analyze, and report this information for the industries we serve. We are taking this opportunity to give back to those that have helped us be successful for more than 14 years. We hope you findthe information contained within this report to be thought provoking, relevant, and insightful. We hope it brings you comfort and helps strengthen your resolve as you continue to face ongoing challenges in the days to come. We hope it provides you with insights that will help you continue to succeed in business.

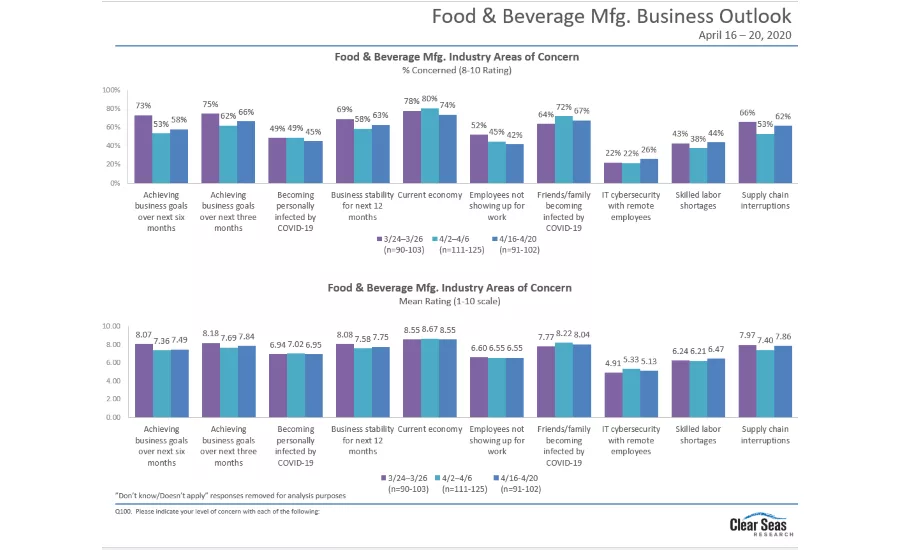

Industry areas of concern - April 16-20, 2020

- 74% concerned about the current economy

- 66% concerned about achieving business goals over the next 3 months

- 58% concerned about achieving business goals over the next 6 months

- 63% concerned about business stability over the next 12 months

- 62% concerned about supply chain interruptions

- 67% concerned about friends/family becoming infected by COVID-19

- 42% (no change) concerned about employees not showing up for work

- 45% concerned about becoming personally infected by COVID-19

- 44% concerned about skilled labor shortages

- 26% concerned about IT cybersecurity with remote employees

Top actions being taken to keep employees healthy, April 16-20:

- Promoting social distancing (83%)

- Providing hand sanitizer/antibacterial soaps (82%)

- Encouraging handwashing (80%)

Anticipated workforce changes in next 3 months, April 16-20:

- Lay off all employees (1%)

- Lay off some employees (21%)

- Temporarily suspend employees with pay (10%)

- Temporarily suspend employees without pay (10%)

- Rehire previously suspended/laid off employees (22%)

- Hire new employees (19%)

- No change (29%)

- Don’t know (14%)

Top three employee mass communication tool implementation, April 16-20:

- Email (87%)

- Phone calls (69%)

- Text messaging/instant messaging (54%)

Top activities of greater focus today relative to 6 months ago, April 16-20:

- Incorporating additional health/safety procedures into business plans (46%)

- Reading more industry publications (digital or print; 24%)

- Investigating new technologies for future business applications (28%)

- Attending more webinars (26%)

- Learning new skills (31%)

- Working on non-billable / lower-priority projects (16%)

- Increasing marketing efforts to remain top of mind (16%)

Click here to read the full report on the Clear Seas Research website.

Related: Clear Seas Research releases report on the effect of coronavirus in the food and beverage manufacturing industry (Part One), Clear Seas Research releases report on industry perspective on the challenges of today, in the age of coronavirus (Part Two)

Looking for quick answers on food safety topics?

Try Ask FSM, our new smart AI search tool.

Ask FSM →