Planting the Food Safety Flag: Plant Protein's 'Better Food' Halo Shouldn't Breed Food Safety Overconfidence

The plant-based foods sector must emerge from its "learning curve" as a mature industry with a strong sense of food safety purpose

Consumers in the developed world expect that food purchased at retail and foodservice establishments is safe for consumption, and consumer research over the past two decades indicates that food safety is one of the most important food attributes for the consuming public. According to the International Food Information Council's 2021 Food and Health Survey, more than half of Americans consider foodborne illness a top food safety concern, and 26 percent say it represents their number-one issue of concern.1

During the past several decades, plant-based foods have moved from their position as "fringe" in the minds of many consumers to mainstream on store shelves and menus. Although small companies new to market sometimes enjoyed a level of forgiveness, plant-based protein's more mainstream position means that expectations will increase. As production expands to match demand, the industry must emerge from its "learning curve" as a mature industry with a strong sense of food safety purpose that matches that of other food industry segments. Proactively aligning knowledge and practices, as well as setting industry standards, is essential as the industry enters its next phase of maturity and sustains customer and consumer trust in these products. This is particularly critical given the "better food halo" often associated with these products, which can lead consumers to be less vigilant in their own safe handling and preparation practices for plant-based foods.

The broad, $7-billion (B) plant-based food sector includes a wide array of foods that are tracked by data technology firm SPINS in 15 different sub-categories. In descending order by 2020 sales, the sub-categories include milk ($2.58 B); meat ($1.48 B); frozen meals ($520 million, or M); ice cream and frozen novelty ($435 M); creamer ($394 M); yogurt ($343 M); protein powders ($292 M); butter ($275 M); cheese ($270 M); tofu and tempeh ($175 M); baked goods and cookies ($152 M); ready-to-drink beverages ($137 M); condiments, dressing, and mayonnaise ($81 M); dairy spreads, dips, sour cream, and sauces ($61 M); and eggs ($27 M).2

Trend-watchers have expressed optimism about the meat alternatives category based on category performance, demographic trends, and opinion polling. Barclay's analysts in 2019 predicted that the market for alternative meat could reach $140 B over the next decade.3 According to The Good Food Institute's 2020 State of the Industry Report,4 the U.S. retail plant-based food market grew 27.1 percent in 2020 to just over $7 billion.

In 2020, consumer researchers Loo, Caputo, and Lusk analyzed relative consumer perceptions of farm-raised beef, plant-based (pea) protein, other plant-based (animal-like) protein, and lab-grown meat.5 On a percentage basis, consumer interest in farm-raised beef captured the strong lead, and researchers noted that plant-based products may be perceived as niche. The authors predicted that increasing familiarity and exposure will place the products in the mainstream and that meat alternatives may capture 28 percent of market share when priced as conventional beef. At the same time, the authors cautioned that demand expressed in the 2020 research may be due in part to novelty.6

Indeed, 2021 came as a shock when the plant-based food industry failed to sustain the explosion of interest seen during the early stages of the COVID-19 pandemic. Earnings releases by major plant-based protein makers in late 2021 showed slower growth and raised questions about the future growth rate of the category. While growth may be uncertain, one thing is clear: More meals that include plant protein will be consumed, and these additional servings mean additional opportunities for both food safety successes—and failures.

This relatively new category is experiencing significant financial investment from both established food manufacturing companies, as well as many venture-backed entrepreneurs and startups with minimal experience in food processing. This substantial infusion of capital is partially supporting innovation in novel plant-based ingredients and new manufacturing processes that are not yet fully validated. The rush to capture market share has the potential to lead to shortcuts in validating the safety of processes and ingredients. Furthermore, companies with limited food manufacturing experience have the potential to overlook the critical importance of truly integrating food safety into the company culture and operating norms.

Looking for quick answers on food safety topics?

Try Ask FSM, our new smart AI search tool.

Ask FSM →

Consumer Food Safety Perception

Limited research exists on consumer views about plant-based food safety. In 2021, Irish food ingredient company Kerry7 polled 1,000 U.S. consumers who self-described as being highly nutrition and food safety aware. Among these consumers, two-thirds cited fresh meat as their number-one food category of concern.8 At the same time, far fewer consumers (49 percent) had questions about the safety of plant-based meat alternatives, while 51 percent of consumers were concerned with plant-based dairy alternatives.8 Kerry's researchers observed that consumers may not intuit that pathogen risks in plant-based meat alternatives are the same as in meat.8

In a polling of 1,000 Canadian consumers by Maple Leaf Foods in February 2022, 45 percent of respondents rated the food safety risks associated with poultry preparation as "high" or "very high," while 39 percent scored beef "high" or "very high"; 28 percent scored fish "high" or "very high," and only 21 percent perceived the food safety risks of plant-based protein preparation as "high" or "very high." Respondents perceived the food safety risks associated with plant-based protein to be more similar to dairy, which 28 percent of respondents deemed "high" or "very high," or to fresh fruits and vegetables, which 19 percent of respondents scored as having "high" or "very high" food safety risks.

In the same poll, consumers were asked whether plant-based foods posed more risks and required more caution in handling, cooking, and storing than meat, poultry, or fish; the same risks requiring the same caution; or fewer risks requiring less caution when handling, cooking, and storing. Sixty percent of consumers said plant-based foods require less caution during cooking, handling, and storing than meat, poultry, and fish; 33 percent believe plant-based foods require the same caution; and seven percent said plant-based foods require more caution. The possibility that a nutrition and food safety "halo" exists over plant-based foods cannot be denied. The fact that Maple Leaf Foods' polling found similar perceived risk levels for plant-based foods and fresh fruits and vegetables further bolsters the notion that perceived nutritional benefits may reduce the perceived need to exercise appropriate safe handling practices when preparing plant-based foods.

Taken together, these findings have significant implications for consumer food safety motivation, as consumers may be less stringent in handling and preparing plant-based foods, despite the fact that they can be mediums for a host of pathogenic bacteria such as Listeria monocytogenes or Salmonella spp. This possibility places a large food safety responsibility on plant-based food makers. Many food safety lessons can be applied to plant-protein production from more mature industries like the meat and poultry industry, which has experienced high-profile food safety incidents. In fact, Maple Leaf Foods applied these kinds of lessons when it acquired Lightlife in 2017 and Field Roast in 2018.

Building a Food Safety Culture

In meeting food safety responsibilities, plant-based protein companies must embrace the concept that no process or technology alone can make food safe. Rather, empowered people applying process, knowledge, judgment, and technology together can achieve the best food safety outcomes. Building a true food safety culture is an essential strategy that should be prioritized when plant-protein companies are established or when they are integrated into a parent company through acquisition. The absence of such a culture can worsen the risks posed by the widely shared consumer perceptions that plant-based protein foods require less food safety vigilance.

Start at the Top

Food safety culture works best when it starts at the top and cascades through deliberate efforts and communications about food safety priorities across the organization at all levels. Maple Leaf Foods and Greenleaf Foods display the companies' written Food Safety Promise throughout headquarters and at all sites. We deliberately work to bring this Promise to life with our written and spoken words and refer back to it often. We say, "Safety is the highest priority over operational needs," and that message is cascaded to the floor through the supervisor group, which is one of the most powerful influencers of food safety culture. We tell our teams often that food safety risks never take a day off, and neither can we when it comes to our food safety journey.

Measure and Manage

Establishing measurable metrics, including a food safety culture survey and targets for continuous improvement, is also essential. These can be categorized as lagging indicators, such as recalls and consumer complaints, and as leading indicators, like assessments of the health of various programs (e.g., sanitation efforts aimed at reducing the risk of bacteria in the environment). Stretch performance metric targets should be set and coupled with a hands-on approach to help facilities achieve these results and reduce risk.

Auditing and tracking performance are essential in maintaining food safety control (Figure 1). Performance against targets should be shared openly—whether the news is good or bad—on a monthly and quarterly basis so that progress and learnings are shared openly. Progress communication should include the organization's senior leadership and CEO/COO. This concept of measurement and governance was described in more detail in the article, “Measure What You Treasure,” published in the February/March 2019 issue of Food Safety Magazine.9

FIGURE 1. Audits and Inspections are Essential in Maintaining Food Safety Control. Photo courtesy of Greenleaf Foods SPC.

Expect Accountability

Part of building an environment of learning and continuous improvement includes understanding failures through root cause analysis and strong corrective and preventive actions. Findings should be shared transparently to encourage learning, and people must be held accountable. Where appropriate, bulletins informing the broader organization of the lessons learned from an incident can be especially effective and provide a mechanism for soliciting feedback and ensuring that execution is achieved.

Empower, Recognize, and Reward

Consistent, merit-based recognition and rewards can greatly reinforce food safety culture desired behaviors. Employees must be empowered and encouraged to stop the line when necessary, and food safety leaders must convey that protecting consumers always trumps profitability. When an employee makes a courageous, fact-based decision to stop the line, that courage should be noted publicly, and the employee should be honored for both vigilance and courage.

Begin the Day with Food Safety

One effective Maple Leaf Foods culture tool is a daily ritual—our "8:30 call" that we initiated after our widely publicized 2008 Listeria recall. Our food safety and operational leads from every plant and headquarters dial in to share good news, lessons learned, and challenges experienced; to exchange ideas; and to collaborate on problem-solving. Our commitment to this call sends a powerful cultural message: We start our days thinking about food safety.

When Maple Leaf Foods acquired Lightlife and Field Roast, food safety leads from those plants began joining the call so they could be initiated into the company's food safety culture. When any plant shows signs of a serious problem, established triggers require our CEO to join the call. The entire food safety network witnesses our company's top leader quizzing site leads about the problem, how it started, and the steps we will take to solve it.

Internalize the 'Why'

It is essential to help employees internalize the "why" behind food safety, and there is no more powerful answer than the voice of someone who has been impacted by foodborne illness. Partnerships with groups like STOP Foodborne Illness can be extremely effective in communicating the potential human toll of complacency.

While Maple Leaf Foods had a tragic event in 2008, giving our company a close-to-home example, we have also partnered with STOP Foodborne Illness to build connections to these powerful and engaging stories. Partnerships like these could be strategic for the growing plant-based food industry, as consumers apparently perceive that less vigilance is needed in preparing plant-based proteins.

Train, Re-train, and Train Again

Food safety education should be prioritized at food companies, especially when building a food safety culture. Online food safety training courses or home-grown training with a clear curriculum, measurement, and reporting performance are key. A focus on supervisor training can be a critical influencer of culture on the shop floor. Attendance at courses offered by trade associations and by leading scientific organizations, like Global Food Safety Initiative (GFSI), convey to teams that the company is committed to learning and to continuous improvement. Food safety certifications should be prioritized. Employees who participate should be honored and recognized publicly.

Achieve a GFSI-Recognized Certificate

Achieving a GFSI-recognized certificate through Certification Program Owners (CPOs), such as British Retail Consortium (BRC), are tools that can differentiate a company from one that is aimed at mere regulatory compliance to one that aspires to a mature food safety program and a higher level of food safety. Although some plant-based protein companies are early in the maturity of their food safety programs, certifications such as GFSI will be the future price of admission to retail store shelves, as the category groups and products become more mainstream and as more retailers seek their own private-label versions of these products.

Strong Internal Auditing is Essential

Audit programs are essential to the effective measurement and management of food safety programs. In fact, good audit programs are like magnifying glasses that identify potential problems before they become commercial crises. Although external audits from certifying bodies can sometimes feel time-consuming and even disruptive, plant protein companies should welcome them as powerful motivators.

Robust internal audit programs help maintain control and prepare for external audits, and companies that lack these programs must work to build them. Although it can be tempting to delay building these types of programs in favor of strategies focused on category growth and innovation, a food safety problem can devastate a young brand that lacks strong reputational equity with customers and consumers, and hurt the industry at large.

Internal audit programs can also be a stepping stone to GFSI certification, and companies are wise to use actual GFSI audit tools as the basis for their own internal audit tools. In launching an internal audit program, it is critical to establish the mindset that internal audits do not exist to make teams feel good; they exist to find problems and, to the extent that they do, they are effective. Tough auditors are effective auditors. When problems are identified, corrective action plans should be developed and executed, and a "no-repeat" mindset must be adopted. Plants must learn from problems and incorporate those learnings into their operations moving forward.

Data generated by internal audits can form the foundation of a continuous food safety improvement mindset. Especially in multi-plant companies, internal audit scores should be shared and compared across the company network to establish healthy competition, to encourage collaboration and problem-solving, and to share best practices.

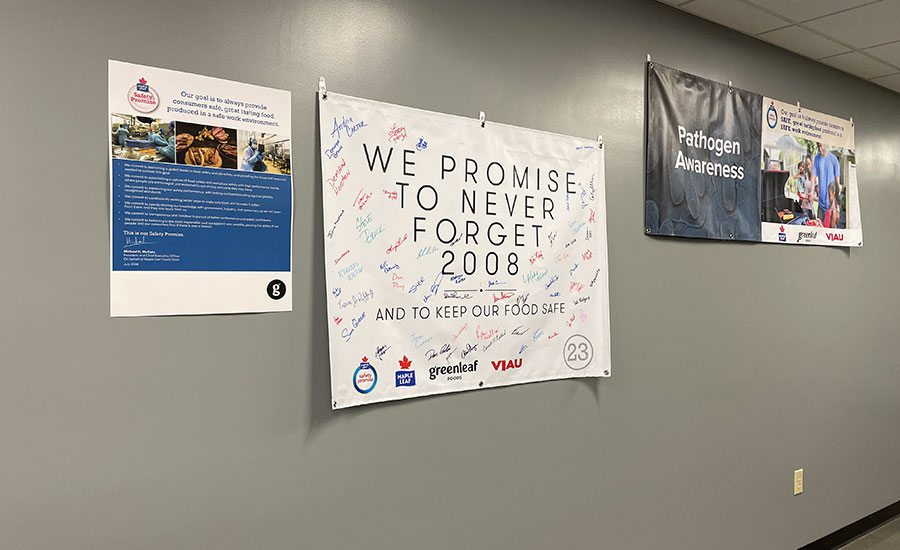

Keep Stories Alive

All too often, companies want to move on from bad news. When it comes to food safety, however, stories of failure can be powerful motivators that should be retold. If a company has experienced a food safety tragedy as Maple Leaf Foods did in 2008, when 23 people lost their lives due to a Listeria outbreak, that tragedy should never be forgotten. At Maple Leaf Foods, our CEO has said many times that, "Victims have the right to move on and forget, but we do not." That's why, each August, we commemorate the tragedy by gathering the entire company together to reflect on what happened, to remember the people who were affected, and to recommit ourselves to our food safety promise (Figure 2).

FIGURE 2. Maple Leaf Foods Commemorates the 2008 Listeria Tragedy each August to Recommit Its Food Safety Promise. Photo courtesy of Greenleaf Foods SPC.

HACCP and Food Safety Plan Development

Prerequisite Programs

In producing safe plant-based protein products, the standard prerequisite programs (PRPs) used to ensure food safety in a variety of food production categories are just as relevant. However, there are some important considerations for food safety professionals who are new to plant-based protein production as they bring their knowledge and skill sets to this industry.

Vendor approval and supply chain control can present some new challenges, for example. Soaring demand for pea protein has led to near-record prices and strain on the supply chain. Both agricultural production and further processing capabilities will eventually catch up to such demand, but in the interim raw materials are needed, and there could be tremendous pressure to overuse the provisional vendor approval option, which could expose the company to raw material risks.

Good Manufacturing Practices (GMPs) are also ubiquitous in food processing, but not all GMP programs are equal. Long-operating plant protein companies have experienced increasing expectations on GMPs due to updated regulations and an expanded customer base. The Sanitation Standard Operating Procedures (SSOPs) that work in other food processing environments will also work in plant-based protein production, but adjustments may be made to chemicals and concentrations to optimize the cleaning of product residues.

Hazard Analysis and the Target Consumers

A necessary step in HACCP and food safety plan development is to identify the product(s) covered by the plan and the expected consumer profile. Most foods are intended for the general population, but some are intended for more susceptible populations, such as children and the elderly. Plant-based alternative products are typically marketed to the general public, but one nuanced factor to consider in hazard analysis is consumer perception of safe handling and preparation for plant-based alternative foods.

As mentioned, surveys indicate that consumers may perceive that because the product is plant-based, normal safe handling and preparation instructions do not apply. This could contribute to potential consumer misuse, leading to cross-contamination, under-heating of ready-to-cook foods, or increased risk of pathogen growth during refrigerated storage. What does this mean to those developing food safety plans? When assessing potential hazards for foodborne bacterial pathogens, a higher risk rating for "likeliness" should be ascribed, resulting in a higher overall risk rating. A higher overall risk rating may raise the hazard to the degree requiring a preventive control.

Pathogen Control

Regardless of whether foods are meat, dairy, or plant-based, the same principles of bacterial physiology and thermodynamics of cooking and cooling apply. The ingoing microbial load of raw materials may be different between the two, but bacterial pathogens occur in both. High populations of bacteria present on hide, hair, hooves, and feathers of red meat and poultry animals, as well as in their gastrointestinal tract, greatly influence the microflora of muscle foods.10 The typical microflora of raw beef, pork, and poultry is diverse prior to further processing, with proportionally greater representation by Enterobacteriaceae than gram-positive bacteria.11

Higher proportions of Enterobacteriaceae mean higher potential prevalence of Salmonella and pathogenic Escherichia coli. Consensus hazard analyses identify the following principal pathogenic microorganisms associated with meat and poultry: E. coli O157:H7 and non-O157 Shiga toxin-producing E. coli and Salmonella with raw beef, Salmonella with raw pork, and Salmonella and Campylobacter spp. with raw poultry. Prevalence and populations of pathogens vary and can be influenced by harvesting and dressing practices and sanitation of the meat processing environment; regardless, killstep critical control points (CCPs) like cooking are designed to address worst-case populations (e.g., 6.5-log to 7-log reductions), which are larger than performance standards for non-meat products (e.g., 5-log reductions).

Raw materials for plant-based meat alternatives include protein isolates and concentrates from soy and wheat, legumes like pea and lupin, or rice and potato. Individually quick frozen (IQF) vegetables used as ingredients could contain Listeria spp. Seed oils and other vegetable oils and dry powders and spices are also used. Such ingredients will have a lesser proportion of Enterobacteriaceae than raw meat and poultry due to source origination and processing, and will have a larger proportion of Bacillus, Lactobacillus, Enterococcus, and Micrococcus, to name a few. Nuts and legumes can be contaminated with Salmonella and could contain mycotoxins depending upon bulk commodity storage conditions.12 Grain-based ingredients like wheat, sorghum, oats, and barley contain spore-forming pathogenic bacteria like Bacillus cereus that survive cooking, as well as non-spore-formers such as Salmonella.13,14 Wheat flour has long been known to contain E. coli and Salmonella,15 and outbreaks have been attributed to consumption of raw flour.16 Therefore, while the microflora of plant-based raw materials may differ from meat and poultry, the target pathogens are similar.

The thermal inactivation rates of E. coli O157:H7, Salmonella, and L. monocytogenes have been well documented in beef, pork, and poultry, leading to defined D- and z-values from which cooking processes can be based.17,18 Cooking critical limits are usually based on the U.S. Department of Agriculture's Food Safety and Inspection Service's Appendix A safe harbor cooking guidelines for meat and poultry.11,19 In pan frying of plant-based burgers, such meat-derived heating schedules have been shown to be sufficient to inactivate these pathogens,12,20 but more work is needed in other plant-based alternative products. Similarly, pasteurization parameters for milk, cream, and dairy products such as 145 °F (63 °C) for 30 minutes (low temperature, long time method), 161 °F (72 °C) for 15 seconds (primary high temperature, short time method), and others that are well established are covered in the Pasteurized Milk Ordinance (PMO).

These heat treatments are sufficient to destroy the most heat-resistant of the non-spore-forming pathogenic organisms historically associated with illness from raw bovine milk, which are Mycobacterium tuberculosis and Coxiella burnetii. However, these are not the most likely pathogens to occur in raw nut milks or oat milks. Rather, Salmonella or L. monocytogenes should be considered the most appropriate target human bacterial pathogens for pasteurization. To date, thermal inactivation rates for pathogens have yet to be published for many plant-based meat or dairy alternatives; as such, erroneous assumptions could be made in devising critical limits for cooking and pasteurization due to differences in heating characteristics.

Besides heating, other process preventive controls are applied to plant-based alternative products that are based on industry standards, but may be influenced by the different microflora and food characteristics. Traditional starter cultures used for fermented sausages or dairy products like cheese, yogurt, and sour cream may exhibit different rates of acidification and peptide production within plant-based substrates. While the safety of traditional, plant-based, fermented products like tempeh is well understood,21 newer, plant-based, fermented products like nut-based cheese and legume- or grain-based, fermented meats require further investigation. Starter cultures and pathogens may respond differently in plant-based substrates compared to meat or dairy due to differences in biochemical composition.

Another prevalent pathogen control step, high-pressure processing, appears to provide equivalent reduction. Shiga toxin-producing E. coli and L. monocytogenes were inactivated in the same manner in plant-based versus beef burgers when high-pressure processed at commonly used pressures and times.22 Other areas in need of research include the growth rates of pathogens on products at refrigeration temperatures (Figure 3).

FIGURE 3. Temperature Control is Essential for Preventing Pathogen Growth on Food Products, Including Plant-based Foods. Photo courtesy of Greenleaf Foods SPC.

Vegetative bacterial pathogens grew more rapidly on plant-based burgers stored at 10 °C (50 °F) compared to beef burgers.19 Similar work is needed on fully cooked, ready-to-eat (RTE) plant-based products. The shelf life of RTE plant-based foods and the inhibition of L. monocytogenes has surely been studied by industry for validation purposes, but much of the data remains unpublished. Some plant-based products have been formulated with microbial inhibitors that are intended to control the growth of L. monocytogenes and other pathogens, as well as spoilage microorganisms, throughout the product shelf life, but the information remains proprietary.

Another key area is the stabilization of cooked products. To date, there are no published investigations into the impact of cooling plant-based products and outgrowth of Clostridium botulinum, C. perfringens, and B. cereus, although these spore-forming pathogens are prevalent in many plant-based raw material ingredients. It is not uncommon for plant-based protein companies to rely on safe harbor cooling temperature and time limits for meat and poultry. While it is not likely that plant-based products would necessarily support more rapid growth, this area of further research and validation could offer industry more options for cooling products (Figure 4).

FIGURE 4. A Thermometer is Used to Check the Temperature of a Blend. Photo courtesy of Greenleaf Foods SPC.

Chemical Hazards

Given that increasing demand for plant-based protein raw materials has strained agricultural production and supply chains, a fresh and in-depth look at potential chemical hazards by the HACCP team or Preventive Controls Qualified Individuals is warranted. Questions to consider include: Are soybeans that were previously only supplied to oil production suitable for this product? Are fields that previously received a heavy regimen of fertilizers for other crops now capable of producing to our standards for legumes? Is our foreign supplier of lentils providing the appropriate evidence of third-party audit performance and positive release testing for pesticides and heavy metals? Has weather impacted the mycotoxin results for our wheat ingredients?

Plant-based raw materials grown, harvested, or packed in agricultural settings that have been used for legumes may also present risks of containing allergenic material. These new raw material supply chains were already under strain to meet demand, and such strains have been exacerbated by COVID-19 and corresponding control measures. These factors could lead to more incidents of use of shared equipment, lack of training in labor forces, and less consistent or less thorough cleaning of processing and transport equipment. These considerations should influence the determination of whether certain allergenic hazards are reasonably foreseeable and the necessary mitigation procedures needed to address them.

In food processing environments, the receipt and handling of dry ingredients can present challenges in terms of removal of allergenic residues from food processing infrastructure and equipment surfaces. Plants producing dissimilar plant-based products with different allergenic raw materials (e.g., pea protein and wheat) must implement strict measures to control dust and mitigate cross-contamination from one area to the other. Dry and wet cleaning techniques must be validated with proper measurements and verified routinely with ongoing environmental allergen sampling.

Many meat processing companies have assimilated plant-based production lines within the same establishment. This risks the transfer of meat species to areas where plant-based foods are processed and, conversely, the transfer of plant-based allergens to meat.

Physical Hazards

Increased demand for agricultural production of protein-rich, plant-based raw materials can mean that farms are adapting to the production of such crops without experience or adequate foreign material controls in place for these commodities. Processors accustomed to receiving and processing meat or dairy-based ingredients may not be adept at identifying foreign materials from plant-based raw materials.

Next Steps: Advancing Toward Maturity

The rapidly maturing plant-based protein industry is at an important crossroads. Product quality and safety expectations will increase among customers and consumers, yet those who prepare and handle the products may not fully understand the role they need to play in ensuring that plant-based proteins are safe when served. A proactive, forward-thinking approach is critical.

The plant-based protein industry must standardize food safety practices, embrace food safety technology and certifications, and build food safety cultures that will support the establishment of sustainable trust among customers and consumers. Auditing bodies, regulators, and food safety professionals must be unified in the message that plant-based food is food, and requires the same rigor in food safety management as the meat or dairy-based products they seek to replicate. Beyond regulation and harmonized standards, internal auditing is an essential step in the identification and control of potential hazards before the regulators or auditors are onsite.

Food safety technical committees within relevant trade associations should be leveraged or built, where needed, to address the technical food safety needs of plant-based food companies and provide resources for implementing and validating food safety practices and principles reflected in industry best practices. Trade associations can establish an environment where food safety learnings can be shared openly, and the entire plant-based food sector can benefit.

Government and academia should fund research to address the scientific data gaps in plant-based foods. For example, pasteurization schedules that worked for many years for milk and cream require further review for efficacy before their application to plant-based milks. Researchers need to establish D- and z-values for Salmonella, Shiga toxin-producing E. coli, and L. monocytogenes in plant-based products.

Retail and foodservice purchasing departments should be encouraged to hold plant-based food manufacturers to the same high standards as they maintain in other, traditional food categories. When customers make purchasing decisions, supplier food safety standards and performance must be considered. This is especially true when new products come to market or when less mature food entrepreneurs enter the market.

As it is often said, consumer trust takes a long time to earn and only a moment to lose. By embracing proven standards and practices, leveraging collective knowledge, and growing plant-based protein food safety research, the plant-based protein industry can position itself for the food safety outcomes that will support its growth and maturity.

References

- International Food Information Council. "2021 Food & Health Survey." May 2021. https://foodinsight.org/wp-content/uploads/2021/05/IFIC-2021-Food-and-Health-Survey.May-2021-1.pdf.

- Orlando, Brian. "Retail Sales Data." Plant-Based Foods Association. April 7, 2021. https://www.plantbasedfoods.org/retail-sales-data/.

- Barclays Corporate and Investment Bank. "Carving up the alternative meat market." August 19, 2019. https://www.cib.barclays/our-insights/carving-up-the-alternative-meat-market.html.

- The Good Food Institute. "2020 State of the Industry Report: Plant Based Meat, Eggs and Diary." 2021.

- Van Loo, Ellen J., Vincenzina Caputo, and Jayson L. Lusk. "Consumer Preferences for Farm-Raised Meat, Lab-Grown Meat, and Plant-Based Meat Alternatives: Does Information or Brand Matter?" Food Policy 95 (2020): 101931. https://doi.org/10.1016/j.foodpol.2020.101931.

- Van Loo, Ellen J., Vincenzina Caputo, and Jayson L. Lusk. "Consumer Preferences for Farm-Raised Meat, Lab-Grown Meat, and Plant-Based Meat Alternatives: Does Information or Brand Matter?" "Section 6: Conclusion and Policy Implications." Food Policy 95 (2020): 101931. https://doi.org/10.1016/j.foodpol.2020.101931.

- Kerry. "Resources: Insights." 2021. https://www.kerry.com/na-en/.

- "Kerry unveils consumer research confirming growing consumer expectations of food safety." Kerry. March 31, 2021. https://www.kerry.com/na-en/latest-news/2021/kerry-unveils-consumer-research--confirming-growing-consumer-expectations-of-food-safety.

- Neumann, Melanie, Marie Tanner, Randall Huffman, and Mike Liewen. "Measure What You Treasure." Food Safety Magazine (February/March 2019). https://www.food-safety.com/articles/6627-measure-what-you-treasure.

- Nychas, George-John E., Douglas L. Marshall, and John N. Sofos. "Meat, poultry and seafood." Food Microbiology: Fundamentals and Frontiers 3 (2007): 105–140.

- Corry, J.E.L. "Spoilage organisms of red meat and poultry." In Mead, G.C. (Ed) Microbiological Analysis of Red Meat, Poultry and Eggs. Sawston, UK: Woodhead Publishing, 2006.

- Cordier, J-L., L. Gram, R.B. Tompkin, L.G.M. Gorris, and K.M.J. Swanson. "Nuts, oilseeds, and dried legumes." In Roberts, T.A. et al. (Eds) Micro-Organisms in Foods 6. Boston, Massachusetts: Springer, 2005.

- Roberts, T.A., J.-L. Cordier, L. Gram, R.B. Tompkin, J.I. Pitt, L.G.M. Gorris, and K.M.J. Swanson. "Cereals and cereal products." In Roberts, T.A. et al. (Eds) Micro-Organisms in Foods 6. Boston, Massachusetts: Springer, 2005.

- Berghofer, Lana K., Ailsa D. Hocking, Di Miskelly, and Edward Jansson. "Microbiology of wheat and flour milling in Australia." International Journal of Food Microbiology 85, no. 1–2 (2003): 137–149.

- Richter, K.S., E. Dorneanu, K.M. Eskridge, and C.S. Rao. "Microbiological quality of flours." Cereal Foods World (USA). (1993).

- Forghani, Fereidoun, Meghan den Bakker, Jye-Yin Liao, Alison S. Payton, Alexandra N. Futral, and Francisco Diez-Gonzalez. "Salmonella and enterohemorrhagic Escherichia coli serogroups O45, O121, O145 in wheat flour: Effects of long-term storage and thermal treatments." Frontiers in Microbiology (2019): 323.

- Goodfellow, S.J. and W.L. Brown. "Fate of Salmonella inoculated into beef for cooking." Journal of Food Protection 41, no. 8 (1978): 598–605.

- McMinn, Russell P., Amanda M. King, Andrew L. Milkowski, Robert Hanson, Kathleen A. Glass, and Jeffrey J. Sindelar. "Processed Meat Thermal Processing Food Safety—Generating D-Values for Salmonella, Listeria monocytogenes, and Escherichia coli." Meat and Muscle Biology 2, no. 1 (2018).

- U.S. Department of Agriculture Food Safety and Inspection Service. FSIS Cooking Guideline for Meat and Poultry Products (Revised Appendix A). Document ID: FSIS-GD-2021-14. December 2021. https://www.fsis.usda.gov/sites/default/files/media_file/2021-12/Appendix-A.pdf.

- Luchansky, John B., Bradley A. Shoyer, Yangjin Jung, Laura E. Shane, Manuela Osoria, and Anna C.S. Porto-Fett. "Viability of Shiga toxin-producing Escherichia coli, Salmonella, and Listeria monocytogenes within plant versus beef burgers during cold storage and following pan-frying." Journal of Food Protection 83, no. 3 (2020): 434–442.

- Ahnan‐Winarno, Amadeus Driando, Lorraine Cordeiro, Florentinus Gregorius Winarno, John Gibbons, and Hang Xiao. "Tempeh: A semicentennial review on its health benefits, fermentation, safety, processing, sustainability, and affordability." Comprehensive Reviews in Food Science and Food Safety 20, no. 2 (2021): 1717–1767.

- Porto-Fett, Anna, Laura E. Shane, Bradley A. Shoyer, Manuela Osoria, Yangjin Jung, and John B. Luchansky. "Inactivation of Shiga toxin-producing Escherichia coli and Listeria monocytogenes within plant versus beef burgers in response to high-pressure processing." Journal of Food Protection 83, no. 5 (2020): 865–873.

Randall Huffman, Ph.D., is Chief Food Safety and Sustainability Officer at Maple Leaf Foods in Mississauga, Ontario, Canada.

Peter Taormina, Ph.D., is President of Etna Consulting Group in Jacksonville, Florida, U.S.

Spir Marinakis is Vice President of Food Safety, Quality, and Technical Services at Maple Leaf Foods in Mississauga, Ontario, Canada.

Janet Riley, M.S., is Vice President of Communications and Public Affairs at Maple Leaf Foods in Mississauga, Ontario, Canada.

Amanda Cox is Director of Food Safety and Quality at Greenleaf Foods in Chicago, Illinois, U.S.