State of Food Manufacturing

2017 State of Food Manufacturing Survey

The top 10 trends affecting the future of food manufacturing

Food manufacturing is generally in good shape, according to Food Engineering readers who were recently polled for our State of Food Manufacturing Survey.

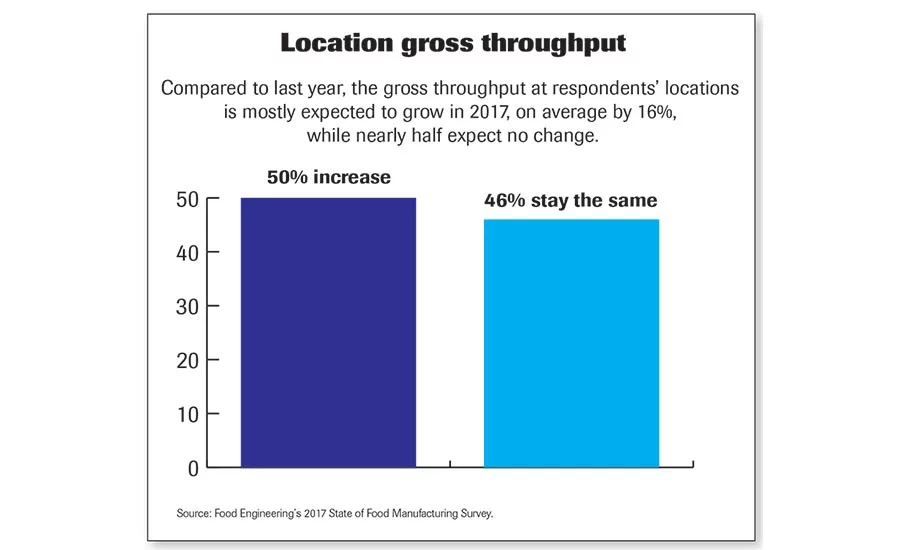

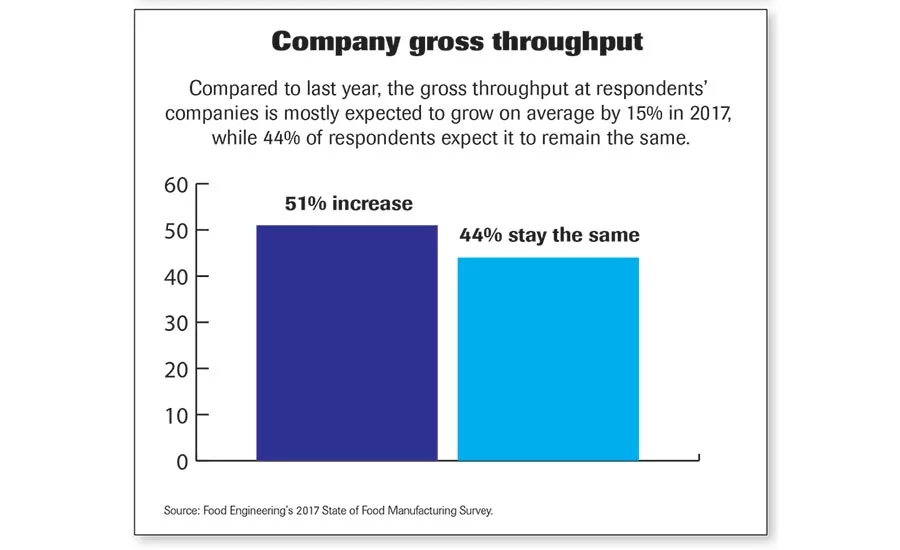

Roughly half of the respondents report throughput is up at their plant locations, as well as their companies, and is expected to grow in 2017 compared to last year. (See Location gross throughput & Company gross throughput.)

The most common reason given by respondents for this expected increase is business growth, with companies adding new products and ramping up activity to meet increasing customer demand.

However, a number of respondents say the growth is coming from their companies finding new efficiencies in production, as well as leveraging their specific plant advantages, such as having a good location and reaping the benefits from investing in adding capacity or building a new facility.

The following takes a look at what readers had to say about the top manufacturing trends in the industry, changes that are happening on the plant floor and in the overall company structures, advances made to boost productivity and insights into food safety management and regulations’ effects.

Article Index:

- Manufacturing operation trends

- Operational changes

- Productivity changes

- Food safety

- Transparency & corporate social responsibility programs

Manufacturing operation trends

Falling in step with past years’ survey results, automation is once again considered to be the most impactful trend that will affect manufacturing operations over the next five years. The following list breaks down this and the rest of the trends identified in our survey’s results.

Top 10 trends

- Automation: To perform more efficiently, plants are employing more automation. Keeping up with increasing demand, rising labor costs and new regulations could be just a few of the reasons why more plants are looking to automation.

- Staff-related issues: With the increase of advanced automation in plants, equipment and manufacturing operations are becoming more complex. Thus, the industry is largely struggling to find qualified, skilled laborers that will replace the wave of Baby Boomers imminently retiring.

- Equipment-related issues: With producing more products in a variety of sizes and packaging, processors must find new and better ways to keep their equipment and processing operations flexible and adaptive.

- Food safety: Keeping food safe has always been important for the industry. Now, processors are increasing their attention on sanitation, preventative control points and allergen-controlling procedures, among other practices, to minimize their risks.

- Government regulations: With the Food Safety Modernization Act compliancy deadlines for small and mid-sized processors coming this year, regulations are top of mind for processors. With the new Presidential administration, there have been inquiries into what laws, if any, will change, but so far, this remains to be unknown.

- New products: Consumers seem to have an insatiable thirst and hunger for new beverages and food with different and exotic flavors based on global influences. This means that CPG companies have a tremendous opportunity in front of them, but how these needs are filled might make all the difference. A recent report on mergers and acquisitions from A.T. Kearney, a management consulting firm, shows a grimmer view of larger food and beverage companies and their sluggish organic growth, possibly due in part to companies not listening enough to consumers’ changing demands. (See “M&A forecast for 2017.”)

- Budget/cost constraints: Over the years, our survey has identified that plant budgets are either remaining flat or just inching up year to year. Companies consistently asking employees to do more with less for many years in a row could stunt future growth.

- Clean labeling: Consumers today are much different than they were just a decade ago. They are highly informed not only about nutrition in general, but also their own personal nutritional needs, thanks to fitness apps and devices. This is evident in the continuing meteoric rise of allergen-friendly foods and other healthful, convenient snacking options.

- Outsourcing: As identified in our June 2017 40th Annual Plant Construction Survey, there is a concern that many plants might not be able to reach FSMA compliancy. However, there are many co-manufacturers and co-packers that have invested in food safety and are seeing their bets pay off through fulfilling more orders from big brand names. (See “Co-manufacturers and food safety.”)

- Technology-related advancements: Processors need to fully understand their operations and gain insights from a floor perspective. To do this, capturing and analyzing the correct data is essential. More innovative companies are leveraging cloud technology, as well as employing more Industrial Internet of Things solutions, to get real-time data in order to drive key improvements and optimize production capabilities.

Operational changes

This year’s survey found, on average, 24 percent of respondents’ location budgets are designated for the purchase of production/packaging/process control equipment/software/professional services. This is slightly up from last year’s 22 percent for equipment purchases. Of this year’s figure, less than $100,000 is allotted for plant equipment for nearly a third of companies.

Looking for quick answers on food safety topics?

Try Ask FSM, our new smart AI search tool.

Ask FSM →

Here is how the budget allocations breakdown:

Budget for production, packaging and processing equipment: The overall 2017 budget for production, packaging and processing equipment is the same as it was in 2016 for the majority of companies, though 41 percent of respondents report an increase, by an average of 43 percent, which is higher than last year’s 27 percent average.

Budget for automation & hardware/software: The overall 2017 budget for manufacturing automation and control hardware/software measures the same for two-thirds of companies compared to last year. A quarter of respondents report an increase of 27 percent on average, which is higher than last year’s 11 percent average.

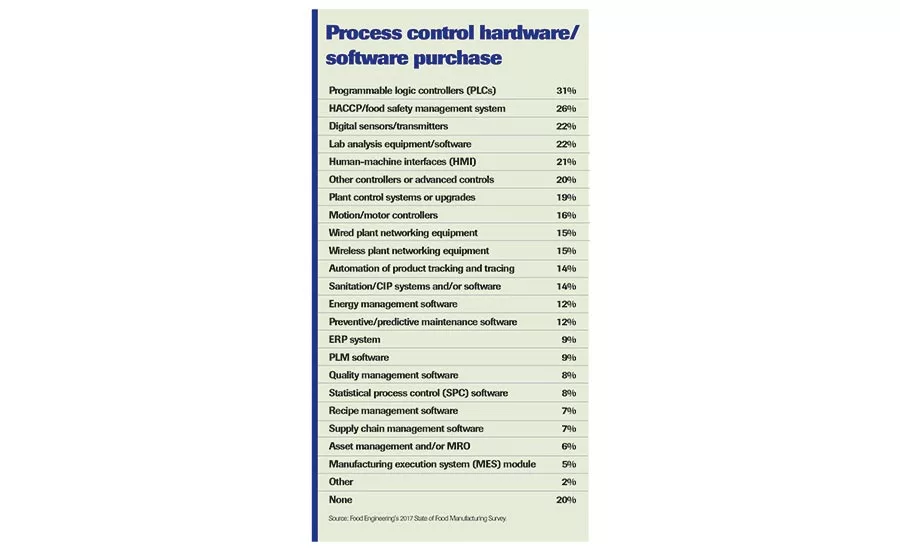

Purchase of process control hardware/software: 80 percent of respondents expect their respective company locations to purchase process control hardware/software in 2017, with PLCs being the most likely item to be purchased. Also, there is a jump in companies planning on buying food safety management software, moving to 26 percent up from last year’s 22 percent. (See Process control hardware/software purchase.)

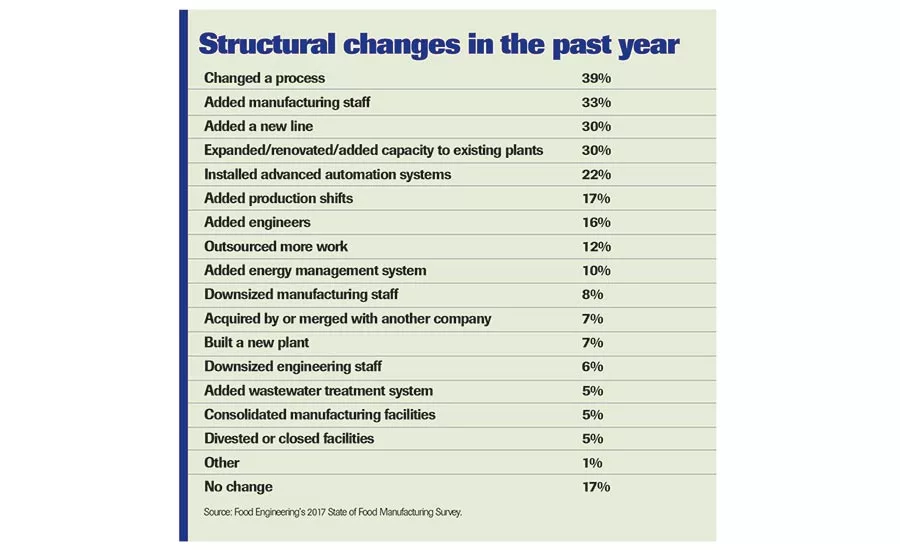

As for overall structural changes happening to businesses in the industry, over a third of respondents report changing a process at their company during the past year. This is followed by another 30 percent saying their companies have added manufacturing staff or a new line, or have expanded/renovated an existing plant. (See Structural changes in the last year.)

Productivity changes

To keep up with demand, processors need to pay acute attention to increasing throughput.

Continuous improvement strategies: As they say, if you don’t measure it, you can’t improve it. There are many manufacturing programs available to the industry for continuous improvement. In fact, 85 percent of respondents’ companies have some type of program in place, with over a third using self-directed work teams and/or total quality management. Other popular practices employed are implementing lean manufacturing and using recommendations that have come from third-party audits.

Opportunities to grow: In order to achieve greater productivity, three-quarters of respondents say equipment upgrades and more skills training for both line supervisors and operators are needed. Better maintenance systems and supply chain management are also areas identified as offering opportunities for productivity improvement. Additionally, respondents say companies should find ways to improve communication between the engineering and IT departments, as well as between manufacturing levels and areas.

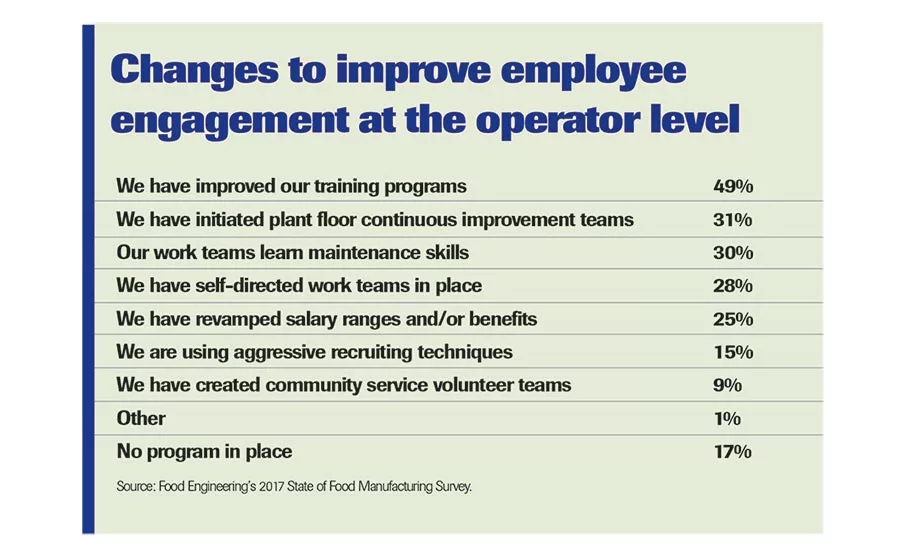

Working with employees: Half of respondents have improved their training programs since last year in order to improve employee engagement at the operator level. However, 17 percent say they still do not have a program in place. (See Changes to improve employee engagement at the operator level.)

Improving packaging operations: Over 40 percent of respondents have taken a new look at improving throughput. Some of the most reported strategies for doing this are upgrading equipment, increasing the level of training operators receive, including involving them more on maintenance issues of their equipment, and making improvements to uptime and changeover speed.

Food safety

Since food safety has consistently been ranked at the top of FE’s manufacturing trends year after year, this year, we wanted to take a look at not only how food safety is being managed on the plant floor, but also how the FSMA regulations are impacting operations.

Food safety management methods: More than two-thirds of respondents say they use lot level traceability, followed by 66 percent that use a recall plan. An almost equal amount of respondents, 63 percent, report engaging staff in comprehensive food safety training and employing food allergen controls.

Preventative controls: To be FSMA compliant, processors will have to present their food safety plans to FDA auditors in order to demonstrate their preventative controls. FE wanted to know what preventative control processors find the most difficult to manage. Over a quarter of respondents say sanitation is the most challenging preventative control to manage. Seventeen percent say they find controlling allergens and managing the supply chain to be their greatest challenges.

FSMA effects: FE wanted to know how FSMA is affecting the industry and businesses. Half of respondents say that food safety regulations have created a financial burden on their companies. However, slightly more (59 percent) say that food safety regulations have had a positive impact on overall food safety.

Transparency & corporate social responsibility programs

Consumers today hold food and beverage companies to higher standards and take note of what they not only say, but do. These developments have increased the importance of transparent and sustainable operations for food processors.

Among the 60 percent of respondents’ companies that have a corporate social responsibility (CSR) program, workplace programs are the most commonly implemented initiatives, at 78 percent, followed by community outreach (69 percent).

Of those that have a sustainability program, 63 percent keep track of water and electricity use per unit of production. Thirty-eight percent calculate their greenhouse gas emissions/carbon footprint. For those food and beverage companies that haven’t begun already, it might be time to start setting strategies and goals to drive social and environmental sustainability initiatives in order to attract more consumers who favor companies that balance the needs of people, the planet and their profits.

Please visit www.clearmarkettrends.com to purchase and download the entire report, and to access a wide inventory of other industry studies. You can also email info@clearmarkettrends.com if you have any questions.

About this survey

The report’s statistics and comments reflect the responses of Food Engineering readers who returned mailed questionnaires or elected to complete the survey online.

Corporate management & administration, engineering personnel, plant operations/production professionals and R&D/product development represent 82 percent of respondents (32 percent, 22 percent, 14 percent and 14 percent, respectively). The remaining respondents are split among QA/QC (8 percent), purchasing (5 percent), warehousing/distribution/logistics (2 percent) and other.

The company location size of respondents translate to: 44 percent with less than 100 employees; 23 percent with between 101 and 250 employees, 19 percent with 251 to 500 employees, 5 percent with 501 to 750 employees, 1 percent with 751 to 1,000 employees and 7 percent with more than 1,000 employees.

The primary products produced by 15 percent of respondents are bakery and snack foods, followed by meat, poultry and seafood (13 percent), dairy and frozen novelty (12 percent), frozen food and prepared meals (10 percent), shelf-stable foods (10 percent), beverage (8 percent) and cereal and grain-based (6 percent). Six percent of the respondents are at corporate and divisional headquarters/R&D/pilot plants; another 6 percent are flavors, ingredients and supplement suppliers; 5 percent produce candy and confectionery products; and the remaining 12 percent are from some other type of food and beverage company.

> See more State of Food Manufacturing reports

M&A forecast for 2017

A new report entitled “Off to New Peaks in Uncertain Times” from A.T. Kearney, a global strategy and management consulting firm, says the food and beverage industry should expect to see more record M&As driven by global growth, consolidation and private equity.

Coming off 2016, where there were 58 huge deals valued at more than $1 billion, the findings say there will likely be more of the same regarding M&As this year, due partly to counteract the sluggish organic growth the CPG market is experiencing.

However, the report also warns that there could be brakes put on some deals due to rising political uncertainty around the world, as seen in the surprise Brexit vote last year, as well as the rising US nationalism, as promised by the Trump administration to “put America first” when creating new tax policies and evaluating trade agreements.

To reach the report’s finding, analysts looked at more than 100,000 consumer and retail transactions from 2005 to 2016 and surveyed more than 100 C-level executives of private equity firms and consumer and retail companies. FE talked to Bahige El-Rayes, co-author of the report and principal in the consumer and retail practice of A.T. Kearney.

FE: One of the main drivers of M&As listed in the report is slow growth. Why are food and beverage companies facing such sluggish organic growth conditions?

El-Rayes: The main reason we’re seeing is that major food companies are over-indexed on highly processed foods, while growing customer segments are quickly shifting toward high-quality, fresh, organic and sustainably produced foods. The top 25 food and beverage companies in the United States have ceded 300 basis points to small and medium-size competitors since 2012 and have grown revenue at 1.8 percent, compared with 11 to 15 percent growth for these smaller companies.

US consumers are voting with their wallets to dethrone large, established food companies. Changes in consumers’ core values—amplified by social media, celebrity chefs and myriad food experts—have worked to reward small and mid-sized companies with above-average growth, while slowing the growth of the top 25 F&B companies.

FE: What are some of the new technologies food and beverage manufacturers will be investing in to foster growth?

El-Rayes: Artificial intelligence is the major up-and-coming technology. Machine learning will be the next frontier to further optimize operations and improve forecasting in this ever-changing consumer environment.

FE: The report says, “Nimble innovators stand to benefit” from the M&As. What are nimble innovators? What will they do for acquiring companies?

El-Rayes: Nimble innovators are companies that have been able to establish the internal and external capability of responding creatively and quickly to changes in the marketplace. They develop innovative ecosystems, which start with identifying the gap or need they are trying to fill, finding the right (usually smaller) partner to fill it and having the capacity to scale these smaller businesses effectively. Major food companies realize that the internal culture and environment of small food companies are very different from their own and often clash. To address this, they have been setting up venture capital funds to buy and hold companies until they mature.

We’ve seen several examples of successful innovations. Open Innovation is the name of a model that is used to externalize innovation through partnership—such as the R&D partnership formed by AB-InBev and Keurig to innovate an in-home alcoholic beverage dispensing machine.

Another model used is arm’s length investment—illustrated by several food companies that are creating their own venture capital funds to drive innovation. One such success story is General Mills’ acquisition of Annie’s Organics, which has increased its sales by more than 9 percent since the deal.

FE: Why do some CPG acquisitions fail?

El-Rayes: Most mergers fail because of a clash in culture or because of unrealistic expectations. The latter happens when multiples are very high, and the investment thesis becomes too stretched. Culture, on the other hand, often becomes the critical factor when making a small-scale acquisition.

FE: Anything else you would like to comment on?

El-Rayes: When will the market become 3G’d out? 3G Global has been calling the shots on the biggest deals for the major food companies, always coming from a position of cost cutting and artificially raising margins higher than anyone else in the industry. Though F&B is big business, consumers have indicated they don’t necessary want cheaper—they want better quality. So, I for one will be interested to see what happens when there’s no more room for F&B company growth simply by cutting costs. At that point, food companies will have no alternative but to disrupt themselves.

For a copy of the report, please visit: https://www.atkearney.com/consumer-products-retail/cirp-ma-executive-report.

Co-manufacturers and food safety

Vanee Foods and Eli’s Cheesecake Company have a lot in common. Even though the former focuses on producing soups and sauces, and the other focuses on delectable desserts, they are both family-owned businesses being run by second and third generations, both are located in the Chicagoland area, and both are focused on food safety.

“Food safety has evolved over time, to how you clean to how you document and how SQF is met. And that’s through our standards and through our people,” says Marc Schulman, president of Eli’s Cheesecake Company.

Schulman’s father, Eli, started in the restaurant business over 70 years ago, with a coffee shop concept that eventually evolved into a dessert production business, which is now housed in a 62,000-sq.-ft. bakery on Chicago’s northwest side.

“We’ve always taken food safety as very important. And now, we have the ways to document and to get better,” he says.

One way Eli’s has improved its food safety operations is by obtaining a Level 2 SQF certification. Putting food safety as a top priority has given Eli’s an added benefit. The company is not a traditional co-packer, but it does have custom customers. Schulman says upholding the company’s reputation through maintaining high standards and quality is an asset for the business.

“Independent food companies have opportunities as long as you’re committed,” he says. “We work very hard to make sure our standards are on the right side of food safety and continue to improve them.”

Luke Vanee, vice president of marketing and communications for Vanee Foods, agrees with this. The company provides a number of different services to a number of different customers, from being a contract manufacturer for globally branded CPG firms to producing private label items for foodservice distributors, as well as custom formulations for chain restaurants.

“We take food safety seriously, and we actually see it as a competitive advantage,” says Vanee. “We’re set up between our culture and the way we use technology to meet and exceed all the market and regulatory expectations. And we can do it at a competitive cost structure compared to many companies doing it themselves.”

Vanee Foods has three separate facilities located in the western suburbs of Chicago. The company is BRC certified and achieved an “A” review through working with Alchemy to train its frontline staff in food safety.

“When we talk about food safety—and now, we have FSMA coming—the mindset needs to be changed,” says Jack Ridge, director of food safety and quality assurance for Vanee Foods. “It’s done by encouraging our workers, understanding where they are, retraining and understanding why we’re doing what we’re doing and what we need to do.”

To implement a food safety culture, Ridge says Vanee’s administrative level believes in leading by example.

“It’s establishing a good foundation by working on the plant floor and understanding the challenges coming and the changes we need to make,” Ridge says.

At a time when many processors are dreading FSMA compliance dates, Luke Vanee says his company is actually excited by the coming regulatory changes.

“It’s almost as if FSMA is our innovation,” he says. “We’re figuring out how we comply and exceed the expectations and how to do it in a cost-effective manner.”

This article was originally posted on www.foodengineeringmag.com.