Cold chain management gets connected in real time

courtesy of Zebra Technologies

courtesy of BluLine Solutions LLC

courtesy of American Thermal Instruments

courtesy of ORBCOMM

courtesy of Kuebix LLC

courtesy of Emerson Cargo Solutions

Technologies that maintain and track temperatures in environments for finished products, from point-of-storage in snack and bakery facilities through distribution to the end customer, are becoming more connected. These systems are being integrated with refrigerators and freezers, temperature controls, and software to track temperatures throughout storage and distribution.

These cold-chain management tools give producers the ability to meet the demands of a rapidly changing marketplace. The snack and bakery supply chain is one of the most-complex, and many ingredients and products require cold-chain control.

A growing field

“Like many other industries, bakery has industrialized and globalized, and we now have major suppliers of bakery ingredients sourcing from, and supplying to, multiple countries. This requires large-scale cold-chain planning, management and logistics with impeccable control and traceability,” says Sue Rutherford, vice president of marketing, ORBCOMM, Ottawa, Ontario. “From a logistics industry perspective, another challenge today is to meet demand in Asia-Pacific, currently the fastest-growing bakery market in the world, but also one where cold-chain infrastructure and equipment are still lacking.”

Government regulations are a key factor in cold-chain management. “FSMA will continue to impact both the food and third-party logistics industries in 2018. While no new FSMA regulations are being contemplated, we expect that more attention will be placed on inspection and enforcement in 2018, particularly regarding Sanitary Transportation of Food and Preventive Controls rules,” says Corey Rosenbusch, president and CEO, Global Cold Chain Alliance (GCCA), Alexandria, VA.

The cold-chain market for food distribution is growing. “The temperature-controlled warehousing and logistics industry has grown for food, as there has been an increase in capacity and growth in non-storage revenue for temperature-controlled warehouses, meaning the ability to provide value-added services is growing, as well,” says Rosenbusch. GCCA’s recent “Productivity and Benchmarking” report shows that storage only accounts for 44 percent of total temperature-controlled warehouse revenue.

GCCA has seen growth in distribution activities of temperature-controlled warehouses in recent years. The group’s research shows an operational emphasis on distribution among participating warehouses increasing from 50 percent in 2012 to 58 percent in 2014, with commodity storage decreasing from 29 percent to 20 percent over those years. By 2016, nearly 39 percent of participating warehouses were solely used for distribution.

Eric Pfeiffer, senior director of supply chain integration, HAVI, Downers Grove, IL, sees an increase in the need for temperature-controlled storage and distribution of bakery items. He says this need is being met in two ways:

In the quick-service restaurant segment more bakery products are being routed through existing distributors that have capacity for temperature-controlled items, which can result in more-efficient distribution to retail locations. There also is the opportunity to deliver frozen bakery items less frequently to restaurants than fresh items. Restaurants can thaw product on a daily, as-needed basis.

Looking for quick answers on food safety topics?

Try Ask FSM, our new smart AI search tool.

Ask FSM →

More new bakeries are built with on-site infrastructure to freeze and store finished goods and distribute via temperature-controlled trucks direct to retail locations.

Data logging

“Data logging is a major part of the equation,” says Carissa Smith, marketing manager, American Thermal Instruments, Moraine, OH. “We see many food brands regulating their suppliers through use of time and temperature monitoring. This ensures that ingredients being put into the end products are kept at the right temperature throughout the supply chain, thus protecting the brand and the consumer.”

BluLine Solutions LLC, Pittsburgh, offers Blulog temperature data loggers that can be attached to returnable containers to monitor and record temperature conditions throughout the supply chain. “Not only does the device identify the temperature of the products when stored or in transit, it can be used to identify the geolocation of the reusable product handling pallet, basket or tray packaging. These containers are expensive, and the companies that own or lease them want to account for them to reduce financial losses,” says Ted Wilkes, vice president, market development.

Data loggers historically required manual intervention to push the data from the devices, according to Ravi Kanniganti, director of vertical marketing strategy, retail and hospitality, Zebra Technologies, Lincolnshire, IL. But times have changed. “Companies are demanding real-time data to ease workflow, enable FDA audits, reject unsafe food deliveries and quickly act if recalls are mandated.”

Now the industry will soon begin moving from data loggers to IoT (Internet of Things) temperature sensors that are connected to the cloud, which will allow alerts to be sent to mobile devices, notes Kanniganti. These devices keep track of the temperatures of perishable and frozen goods, alerting users if temperatures change in order to prevent spoilage and loss.

“Recent developments in IoT sensors, mobility and cloud computing are enabling the deployment of these solutions more quickly and cost effectively,” says Kanniganti. “We can expect to see wider adoption of these technologies due to regulatory pressure and the quest to protect brand value.”

Bluetooth technology is allowing temperature monitoring to become hands-free. “The ease of just opening a truck or getting within range of the product in a large warehouse to pull temperature data definitely saves time and labor,” says Smith. Connecting physical devices to digital tools allows for quick access to the information and retention of digital information, he notes.

Real-time connectivity

Real-time connectivity—including the ability to remotely adjust transport temperature settings—is increasingly viewed as mission-critical to reduce claims, enhance customer satisfaction and ensure regulatory compliance. As a result, more cargo owners are looking for logistics and transportation suppliers that can help them manage their supply chains with real-time updates on delays, malfunctions and other problems, allowing remedial action to be taken to avoid breakdowns.

“Advances in sensor technology mean that telematic devices can now be paired with multiple sensors to track temperature, humidity, shock, intrusion and other critical conditions. All of this provides a wealth of immediate operational data and longer-term insight to inform supply-chain strategy,” Rutherford says.

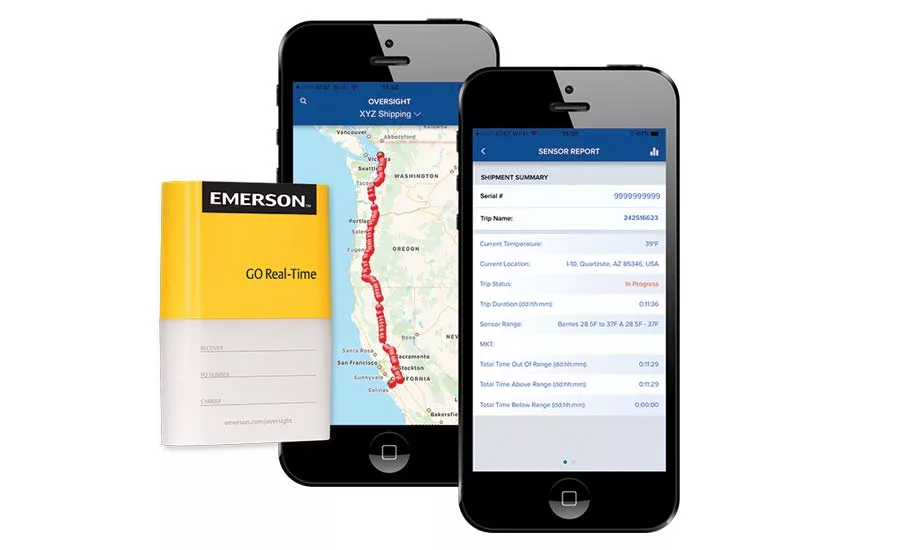

Providing real-time, actionable data to brand owners via IoT or cellular technologies helps solve problems in real-time, reducing food waste, increasing food safety and automating recordkeeping, notes Amy Childress, vice president, marketing and planning, Emerson Cargo Solutions, St. Louis.

The company offers several IoT solutions for tracking food on the move, including a line of GO Real-Time Trackers, which transmit data via cellular to an Oversight portal. “Real-time temperature alerts and location are delivered to users and historical temperature data is stored,” Childress says. Another option, GO Wireless Loggers, are placed on loads by suppliers. Food is shipped to a retailer’s distribution center. When the truck arrives, the doors are opened and the loggers automatically transmit their data to the gateway.

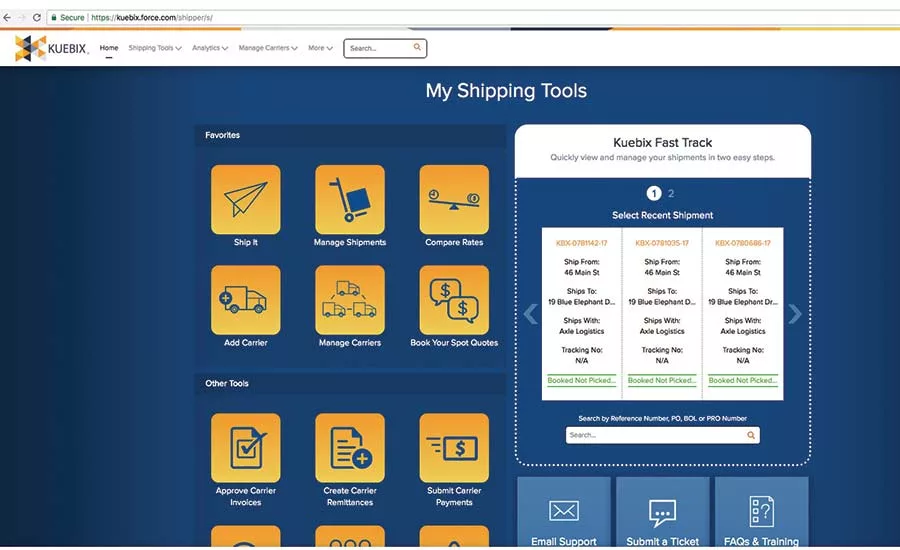

Kuebix LLC, Maynard, MA, offers full tracking and visibility of freight expense down to the SKU level via its transportation management system (TMS), which integrates internal and third-party systems to track what’s happening in real time. “With Kuebix TMS, clients can see on any device where their products are, as opposed to having to check the websites of multiple carriers. They can manage freight from anywhere. In addition, the system can integrate data from across the cold chain and create reports, such as carrier on-time performance,” says Dan Clark, founder and president.

Wilkes sees an emerging trend with product packaging becoming active and intelligent, with products themselves reporting and capturing information about the journey and storage conditions throughout the supply chain. “Intelligent data, such as product batch, perishable life and exposed temperatures that can impact shelf life and the final baking process, will be reported live,” he predicts. “This will enable the receiver of inbound goods to deny receipt of product before it is unloaded and provide intelligence about the product journey to the shipper to improve quality control.”