In our last Food Safety Insights column, we discussed the size of the worldwide market for food safety microbiology testing. We reviewed the world market for testing, the types of tests and their market value and growth prospects. But the market is not uniform across all regions of the world, and there are great differences in food safety testing practices in different regions. The drivers of these differences include access to technology, labor costs and availability, the structure of the regional food processing business and, in some cases, reluctance to change. This issue, we’ll look at these differences and why they are important to understand, whether you run a global food business, food diagnostic company or perhaps invest in or sell to such businesses.

Who Tests Most, Worldwide

Total test volumes break down as follows:

• North America: 30 percent

• Europe: 31 percent

• Asia-Pacific: 29 percent.

• Rest of the world: 10 percent

.jpg) Approximately three-quarters of the tests (Figure 1) are routine tests; the rest are for pathogens. This distribution may appear even, but these regions differ in size and population. Additionally, when the regional test volume is scaled for population, the data show a very different picture. The ratio of food microbiological tests to population size is highest in North America (0.9/person), second in Europe (0.6/person) and lowest in Asia (0.07/person).

Approximately three-quarters of the tests (Figure 1) are routine tests; the rest are for pathogens. This distribution may appear even, but these regions differ in size and population. Additionally, when the regional test volume is scaled for population, the data show a very different picture. The ratio of food microbiological tests to population size is highest in North America (0.9/person), second in Europe (0.6/person) and lowest in Asia (0.07/person).

Testing volumes should normally fluctuate in rough proportion to the volume of food and the types of foods being produced. In a uniformly well-nourished world, this should also correlate with population size. Economic development, as we know, is not uniform, and there are developing countries in Asia and elsewhere with low levels of industrialization of food production, as well as areas with issues of significant food insecurity. Food produced by local farmers and sold in local markets probably will not be tested at all, and if there is insufficient food available, the safety of the food will be less important than simply getting something to eat. North America and Europe are less impacted by—although not immune to—food shortages, and Western diets are more typically based on meat, processed foods and ready-to-eat foods, all of which will carry a heavier burden of analytical food testing.

Factors That Impact Test Volume

Food Security

According to the Food and Agriculture Organization of the United Nations, however, the availability of food in Asia and throughout the developed world is now, on average, above 75 percent (as measured by daily calories) of that available in the developed world. Consumption of unprocessed vegetables and grains is steadily being replaced by consumption of more processed grains, sugar, vegetable oils, meat and dairy. As this trend continues, more food will be provided by food processors, which will increase testing. This movement points to the tremendous potential for growth of the Asian food processing market and the subsequent potential of the Asian food testing market. If one were to project the test-volume-to-population ratio for Europe to the population of Asia, the volume of testing in Asia alone would amount to more than double the current total world testing volume.

Test Distribution

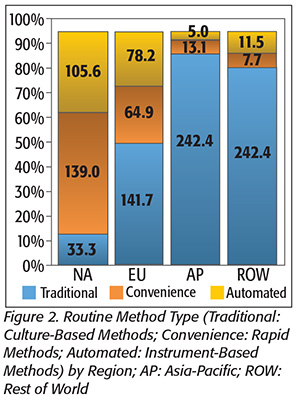

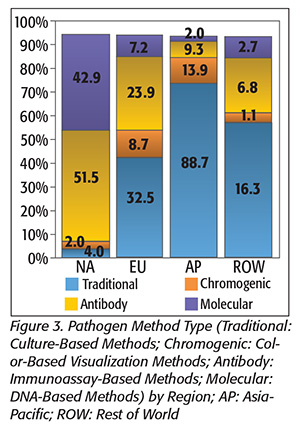

The distribution of test methodologies used is also not consistent across the globe, with large differences in how tests for both routine (Figure 2) and pathogen (Figure 3) samples are conducted. These differences affect the structure of the regional markets and greatly impact the market value of each region.

The distribution of test methodologies used is also not consistent across the globe, with large differences in how tests for both routine (Figure 2) and pathogen (Figure 3) samples are conducted. These differences affect the structure of the regional markets and greatly impact the market value of each region.

Test Type

Test Type

In North America, routine tests more often use higher-value convenience methods that can sell for between $1.00 and $3.00, whereas in Europe, routine tests are more often performed using traditional, plated media that sell for less than $1.00. Pathogen testing in North America is also more strongly oriented toward higher-cost, instrument-based and rapid methods, with 94 percent of tests using molecular or immunoassay methods, whereas in Europe, only 43 percent of pathogen tests use these technologies. Testing in Asia is distinctive in that nearly 90 percent or more of both routine and pathogen testing are still performed using traditional growth methods.

This disparity in test type has an important impact on regional market values, despite the regional test volumes being similar.

Instrument-based, pathogen-detection methods have a selling price in the range of $8–$16 per test, whereas the growth-based, traditional media tests used for most samples in Asia can have a selling price of $1 per test or less. This disparity greatly weights the market values in the regions, with the market in North America accounting for 40 percent of total worldwide market value, and Asia accounting for only 21 percent of the world market. Europe, with a more evenly mixed distribution of test types, accounts for a more proportional share of the world market at 33 percent.

World Region

As mentioned earlier, these differences are driven by different regional concerns. Companies in North America and Europe have shown an interest in investing in high-capital cost, but labor- and time-saving, technologies. Companies in Asia, however, have been more focused on using diagnostic tests with the lowest direct cost and have not had the same pressures on labor cost as their counterparts in other regions. Asian companies report that they have less trouble in hiring and retaining skilled laboratory staff than their U.S., Canadian and European counterparts. Asian companies also report that they have a greater number of highly trained scientists and technicians to choose from and that it is not unusual to have a Ph.D.-level microbiologist running samples at the bench or supervising those who do. This scenario would be unusual to see in an American or European laboratory. Having this level of skilled individual available to conduct and analyze growth-based methods removes some of the advantages of instrument-based methods.

The Take-Away

These differences are important to understand. Should these labor conditions change in Asia, across the region or in certain countries or even regions within countries (e.g., China, where regional labor conditions can vary), we should expect to see demands on laboratory staffing change. Furthermore, considering that rapid instrument-based technologies are readily available, the adoption of new methods could be very swift. Food safety testing requirements continue to be harmonized by the globalization of certifications, buyer’s requirements and supply chain consolidation, and these pressures may also require producers to quickly adapt and change their processes. As this progress continues, test methodologies in Asia and the rest of the world will better align with those used in North America and Europe, driving higher growth rates in the future. The diagnostic testing company that misses these market signals could easily miss its market

opportunities.

Bob Ferguson is the managing director of SCI.